Insights turns 1!

Can you believe it? It’s been one year since we introduced personalised Insights and Auto-Savings, and what a year it’s been!

From forecasting finances to savings surprises, it’s been quite an exciting and rewarding experience and we want to express how grateful we are to all our customers who’ve joined us on this ride. We hope you’ve learnt more about your personal financial wellness over the past year.

Every month we generate over 1.4 million personalised Insights, helping people like you understand more about the way you spend, discover opportunities to save and stay on top of your finances. We’ve also gotten to know you a little bit more which helps us shape our products and services and become an even better bank for you.

Check out the numbers

2700 | nudges sent every month to help our Bonus Saver customers get their bonus interest. |

4440 |

potential savings opportunities identified every month. |

8500 |

the number of warnings we send monthly about insufficient balances for predicted upcoming spending and bills…helping to keep you on top of things and avoid embarrassment. |

75,000 |

times a month we help a customer better understand their purchase behaviour or money movements with our cash flow or purchase analysis insights. |

285,000 |

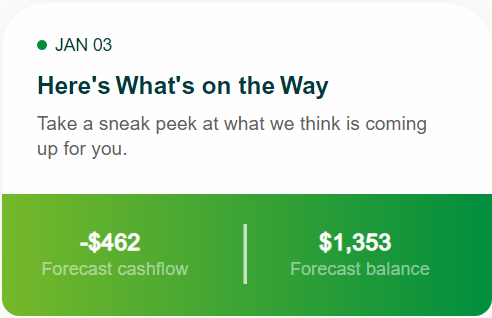

each month, we send out this many predictions of what will flow in and out of accounts, so customers like you can make plans or adjustments if you need to. |

#1 Insight

Our #1 ranked Insight lets you know what’s coming up in your accounts in the next fortnight. By analysing your transactions and behaviour we’re able to predict your future payments so you can take action if you need to (or just sit back and relax).

$750,000+

The amount our customers have collectively saved through Auto-Savings!

This number is always on the rise, as Auto-Savings continues to locate available funds and automatically transfers them to savings accounts.

$1237 | The average amount our customers have saved through Auto-Savings |

$24.69 |

Typical amount of an Auto-Savings transfer – not quite the 50c of rounding up the price of a cup of coffee! |

Interested in Auto-Saving?

If you’re eligible1 for Auto-Savings you’ll receive an invitation in your Insights hub. Follow the prompts to opt-in and then sit back and watch your balance grow!

Here’s to another great year ahead

Thanks for being part of our 1st year, we couldn’t have done it without you.

It’s still early days but we’re an ambitious bunch, and now in our second year things can only get better!

Which reminds us, don’t forget to keep interacting with your Insights - the more you do, the more you can learn from them. Let’s keep this momentum going!

1To be eligible for the Auto-Savings feature, you must have at least one of the following active transaction accounts: Glide / Everyday / Access / Basic / Fee Cruncher / The Only / Youth. You’ll also need an active savings account. But don’t worry, if you don’t have one already you can open one in the Auto-Savings set up.