Save more with $0 everyday fees

We don't charge you for everyday use of your Bonus Saver account

Other fees and charges may apply. For more information about the Bonus Saver account please see terms and conditions, financial services guide, interest rates.

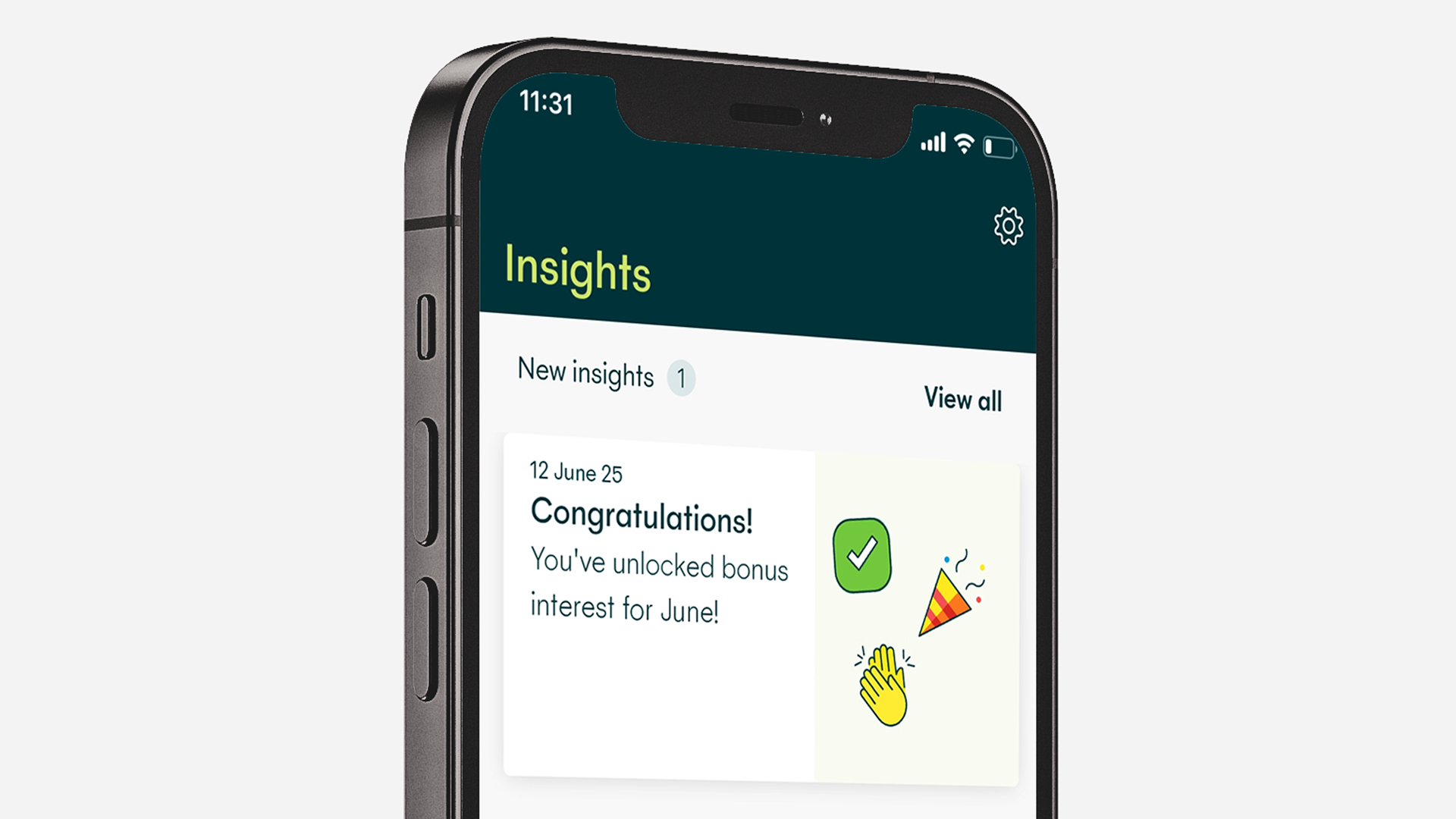

MyState app

- Fingerprint and face login, personalised insights and online statements are just some of the ways we make banking easier.

- Osko payments let you send and receive money in under 60 seconds.2

- Receive money using a mobile number or email address by registering a PayID.

Open an account online in under 5 minutes

Provide personal details

You can open the account for up to 2 people. Just provide the usual stuff like your name & address.

Verify with ID

You will need one of the following: Australian Driver License or Passport.

Link a Glide account

Simply check the box and we will open your Glide account using the same details.

Learn more about your Bonus Saver account

A bonus interest savings account offers customers access to additional and more competitive interest rates on their saved balances when eligibility criteria is met, helping you to build your savings balance faster. When you unlock bonus interest, you are effectively boosting your savings balance every month just by saving in the first place. Interest is paid directly into your bonus account each month.

You can open a savings account at any time online or get in contact with our customer care team on 138 001 to learn more about our offerings and how we can help you reach your savings goals. We also offer customers a joint savings account, for when you’re saving with a partner.

To help you predict your potential savings, consider using our savings calculator with manual inputs like the time you are calculating your savings over and the current interest rate on your savings account. You can also use our term deposit calculator to work out how any of our long-term deposits might fit your personal finances better.

With a Bonus Saver account interest on your saved balances is calculated daily and paid into your account monthly. These interest rates are subject to change from time to time. Our bonus interest is also only available on balances of up to $500,000 with the standard base rate of interest paid on any portion of your balance which exceeds $500,000.

You can earn bonus interest on your saved balances with this type of account by following these easy steps:

- Deposit at least $20 in your Bonus Saver account each month.

- Make at least 5 eligible Visa Debit card transactions each month from your linked MyState Glide account.

Meeting the eligibility criteria means that you unlock the variable rate plus the bonus interest. You also retain the freedom to withdraw your money whenever you want to.

If our bonus interest savings account isn’t exactly what you’re looking for then you may like to consider our other types of bank accounts. MyState Bank offers a range of transaction accounts to choose from as well as other dedicated savings options. It’s always a good idea to compare savings accounts to ensure that you’re choosing the best option for you.

Eligible deposits to your Bonus Saver account to meet the criteria for bonus interest include: Transfers between your accounts, direct credits, NPP transactions, cash deposits, SWIFT payments and Telegraphic Transfers (TT).

Ineligible deposits to Bonus Saver account to meet minimum deposit criteria include: Bank@Post deposits or transfers, cheques, money orders, travellers cheques, international drafts and foreign currency. Interest credit, fee refunds or returned payments are also ineligible.

Eligible Visa transactions must be settled in the current month (not pending) on the linked account and include; eftpos transactions and eftpos transactions with cash out, online purchases and in store purchases, regular card payments, payWave, Apple Pay, Google Pay, Samsung Pay, Garmin Pay and Fitbit Pay transactions.

The following card transactions are ineligible: eftpos cash out only transactions, Local and International ATM withdrawals, transfers or balance enquiries, Cash Advances and Pending Card Transactions. The term ‘Settled (not pending)’ means for any purchases made on your card, that the transaction must be fully processed to your account during the current month and not have a pending status at the end of the month. Transactions with a pending status at month end do not count towards your 5 eligible Visa transactions however will count towards eligible transactions in the following month when they settle.

You can have one Bonus Saver account in your name and you can also have a Bonus Saver joint account with another individual.

Get in the know

Resources

Financial services guide

Terms & conditions

Fees and charges

Interest rates

Switch your salary over

Overseas travel

Inward telegraphic transfer

SMSF options

Bank account calculators

1 Interest calculated daily, paid monthly and interest rates subject to change from time to time. Bonus interest applies when eligibility criteria met. Bonus interest is payable only on balances up to $500,000. The base rate of interest will be paid on the portion of any balance exceeding $500,000. Current interest rates are available in interest rates for personal deposit accounts.

Eligible deposits to Bonus Saver account include: Transfers between your accounts, direct credits, NPP transactions, cash deposits, SWIFT payments and Telegraphic Transfers (TT).

Ineligible deposits to Bonus Saver account include: Bank@Post deposits or transfers, cheques, money orders, travellers cheques, international drafts and foreign currency. Interest credit, fee refunds or returned payments are also ineligible.

Eligible Visa transactions must be settled in the current month (not pending) and include; eftpos transactions and eftpos transactions with cash out, online purchases and in store purchases, regular card payments, payWave, Apple Pay, Google Pay, Samsung Pay, and Garmin Pay transactions.

The following card transactions are ineligible: eftpos cash out only transactions, Local and International ATM withdrawals, transfers or balance enquiries, Cash Advances and Pending Card Transactions. The term ‘Settled (not pending)’ means for any purchases made on your card, that the transaction must be fully processed to your account during the current month and not have a pending status at the end of the month. Transactions with a pending status at month end do not count towards your 5 eligible Visa transactions however will count towards eligible transactions in the following month when they settle.

2 Payments are typically received in under a minute when made between participating financial institutions. PayID is only available for use with the New Payments Platform through participating institutions.

Apple Pay is a trademark of Apple Inc., registered in the U.S. and other countries. Google Pay is a trademark of Google LLC. Samsung Pay is a trademark or registered trademark of Samsung Electronics Co., Ltd. Garmin Pay is a trademark of Garmin Ltd. or its subsidiaries.

RateCity Gold Award 2021, 2022, 2023 and 2024. Mozo Experts Choice Award 2022 and 2023. Finder Awards Highly Commended 2023 and 2024.