MyState strengthens balance sheet and delivers stable dividend

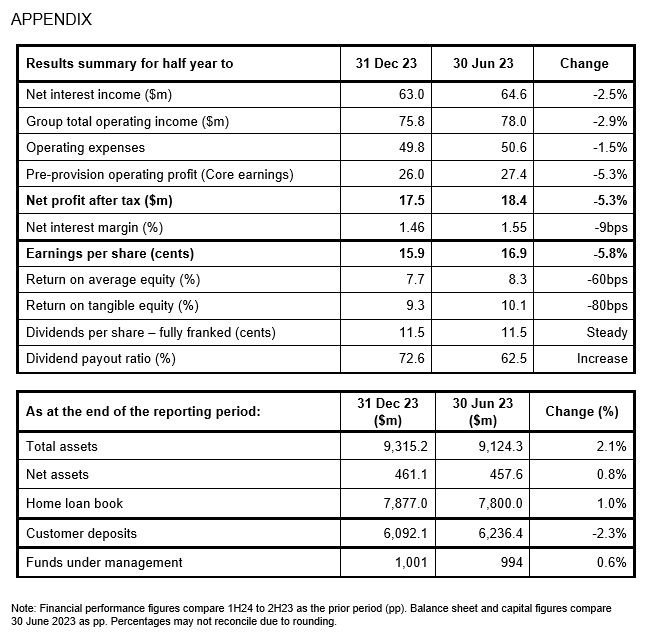

MyState Limited has continued to grow its new to bank customers and lending book within a challenging operating environment. The Board has declared a stable dividend that is close to the mid-point of the MyState target payout ratio range. Key highlights relative to 2H FY23:

- New to bank customers up 4% or 7,690

- Home lending up 1% to $7.9 billion

- Net promoter score up 7 points to +41

- Net Interest Margin (NIM) at 1.46%, down 9 basis points

- Operating costs 1.5% lower to $49.8 million

- Core earnings down 5.3% to $26 million

- Total capital ratio up 16 bps to 15.6%

- TPT funds under management back above $1 billion at 31 December 2023

- Interim dividend stable at 11.5 cents per share

Managing Director and CEO Brett Morgan said “MyState Limited had a solid first half, with growth across lending and funds under management delivered off a lower cost base.”

“The current operating environment has created short-term challenges. Competition in the home lending and retail deposit markets has driven industry NIMs lower and high inflation has impacted costs.”

“MyState continually evaluates the balance between growth and margin which led to our decision to temporarily rebalance our lending growth aspirations for FY24. Further, our focus on extracting efficiencies and expense management has delivered a first half reduction in operating costs.”

“While expenses were lower, we continued to invest in strategically important initiatives including customer experience, digitisation and cyber and fraud resilience.”

“Pleasingly, MyState attracted almost 7,700 new to bank customers over the half. Our customer growth has come while maintaining high customer advocacy, as measured by our net promoter score.”

“We are happy to report that credit quality remains sound. While there was a small increase, Bank arrears rates continue to be below the industry average, losses are negligible and there are no Mortgagee in Possession loans as at 31 December 2023.”

During the half TPT Wealth delivered growth in funds under management, increased Trustee Services revenue and lowered costs.

Mr Morgan said, “It is pleasing that after a challenging period, TPT is starting to see benefits as we execute our strategy.”

MyState’s capital position has strengthened with a total capital ratio of 15.6% at 31 December 2023.

Mr Morgan commented, “Since launching our growth strategy in 2021, we have grown our mortgage and deposit portfolios by 45% and 37% respectively. MyState is ready to further accelerate growth as the operating environment improves”.

Demonstrating the Board’s confidence in MyState’s financial position and its potential to grow, the Interim dividend has been maintained at 11.5 cents per share, representing a payout ratio of 72.6%. The dividend is fully franked and is payable on 22 March 2024 to all shareholders on the register at the record date of 29 February 2024. A Dividend Reinvestment Plan (DRP) will be offered to shareholders for the Interim dividend with an election date of 1 March 2024. DRP shares will be issued at no discount to the volume weighted average price for the period 4 March to 8 March 2024 inclusive.

Customer growth: MyState welcomed 7,690 new to bank customers over the half year with strong growth in Tasmania, Victoria, New South Wales, and Queensland.

Home loan book growth: MyState’s home loan book grew to $7.9 billion at 31 December 2023, with growth centred on the lower risk <80% LVR segment of the market.

Competitive market drives net interest margin: NIM fell 9 bps over the half year to 1.46%, reflecting continued competition for deposits and mortgages, deposit switching by existing customers, an increase in term securitisation funding and higher liquid assets.

Credit quality: in line with the broader industry, there has been a small increase in arrears. Arrears remain below the industry average with 30+ day arrears at 0.91% and 90+ day arrears at 0.39%.

Cost-to-income: overall costs fell 1.5%. The Group cost-to-income ratio increased 170 bps to 65.7% primarily as a result of NIM compression.

Capital: MyState continues to focus on maintaining a sound capital position and balance sheet. During the half MyState completed a $500m capital relief term RMBS transaction and drew down on a committed warehouse facility established in June 2023.

FY24 outlook:

Based on current market conditions, MyState is focused on profitably and sustainably executing its growth strategy. MyState expects to achieve the following for FY24:

- MyState Bank lending: lending growth around 1x system

- MyState Bank deposit composition: customer deposits >70% of funding

- Earnings per share: 31.1 to 32.8 cents per share

- MyState Bank underlying cost to income ratio: 64% to 66%

- Return on equity: between 7.5% and 8.0%