MyState demonstrates resilient FY24 results and proposes merger with Auswide Bank

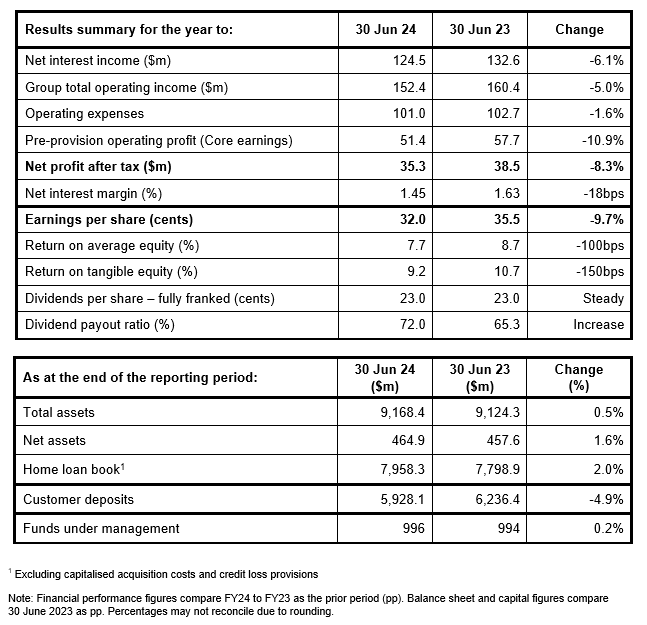

MyState Limited has delivered an FY24 net profit after tax result of $35.3 million, surpassed $8.0 billion in lending, welcomed over 14,000 new to bank customers and successfully launched its new internet and mobile banking platforms while controlling costs. The Board has declared a stable final dividend of 11.5 cents per share (cps), taking the full year dividend to 23.0 cps, representing the mid-point of the MyState target payout ratio range.

Concurrently, MyState has signed a scheme implementation agreement to merge with Auswide Bank (ASX: ABA). The proposed merger is expected to be EPS accretive from FY26 on a post synergies run rate basis.

Key highlights in FY241:

- Home lending up 2.0% to $8.0 billion

- New to bank customers 14,100

- Net promoter score (NPS) up 23 points to +58

- Total operating costs down 1.6% to $101.0 million

- Net profit after tax (NPAT) of $35.3 million, down 8.3%

- Total capital ratio up c.100 bps to 16.4%

- Stable final dividend of 11.5cps, full year dividend of 23cps

- Net Interest Margin (NIM) 1.45% stable half on half

- Improved performance in Trustee Services business

- Successfully launched new internet and mobile banking platforms

Managing Director and CEO Brett Morgan said, “MyState Limited managed the balance between growth and margin well in FY24 and our focus on extracting efficiencies and expense management delivered a reduction in operating costs in an inflationary environment.”

“We have maintained our focus on growing profitably while delivering on a range of important strategic initiatives including the launch of a new internet and mobile banking experience and an expanded Trustee Services offering. Along with efficiency initiatives delivered across the Group which supported a reduction in total operating costs, we have set strong foundations which will help to drive profitable growth into the future.”

“Pleasingly, we attracted more than 14,000 new to bank customers during FY24. Customer advocacy significantly increased over the year, with our NPS lifting to +58, reflecting our continued customer focus.”

“We are also happy to report that credit quality remains sound. Bank arrears rates continue to be below industry average, and we continued to work closely with customers experiencing financial hardship.”

“During FY24, TPT Wealth delivered stronger revenue off a lower cost base. As a result, it contributed positively to the Group’s financial performance.”

MyState’s capital position has strengthened with a total capital ratio of 16.4% at 30 June 2024, up from 15.4% at 30 June 2023, providing capacity for future investment and growth.

The MyState Board has declared a final dividend of 11.5 cps, taking the total dividend for the financial year to 23.0 cps, representing a payout ratio of 72%. The dividend is fully franked and is payable on 16 September 2024. The Dividend Reinvestment Plan (DRP) will be offered to shareholders for the final dividend with an election date of 26 August 2024. DRP shares will be issued at no discount to the volume weighted average price for the period 27 August to 2 September 2024 inclusive.

MyState signs proposed merger with Auswide

Key highlights:

- MyState Limited (MyState) has signed a scheme implementation agreement (SIA) to merge with Auswide (the Proposed Merger)

- Under the Proposed Merger, Auswide shareholders will receive 1.112 New MyState shares per Auswide share, implying 65.9% pro forma ownership of the combined group for existing MyState shareholders2

- The Proposed Merger is expected to deliver strong value accretion and be EPS accretive from FY26 on a post synergies run rate basis

- The combination of two high-quality, complementary businesses will deliver significant scale, contributing to improved operating efficiency from a larger balance sheet and increased funding flexibility

- Targeting implementation in mid-to-late December 2024, subject to customary regulatory, Auswide shareholder and third-party approvals

Mr Morgan said, “In addition to delivering a solid FY24 result and executing on important strategic initiatives, I am delighted to announce that MyState has today signed a scheme implementation agreement to merge with Auswide Bank. The combination of two high-quality and complementary businesses is consistent with our stated growth strategy and brings significant scale advantages to the Group. We expect significant cost synergies from the merger, which we also expect to be EPS accretive for MyState shareholders from FY26 on a post synergies run rate basis. The scheme, which is subject to the customary regulatory, Auswide shareholder and third-party approvals, is expected to become effective in mid-to-late December 2024.”

MyState’s Chair Vaughn Richtor said, “We look forward to the value creation arising from merging two sound customer focused businesses with long histories of serving their local communities.”

The opportunity to accelerate earnings and growth

It is expected that the Proposed Merger will significantly enhance the scale and value proposition of the Group, providing it with the opportunity to accelerate its earnings and growth profile while benefiting from an enlarged balance sheet and increased funding flexibility.

MyState and Auswide have quality loan books evidenced by their low arrears and loyal customer bases. The Proposed Merger will also further diversify loan balances by geography and support deposit generation.

Significant value creation for both sets of shareholders

MyState expects significant pre-tax cost synergies of between $20m to $25m and the merger is expected to be EPS accretive for MyState shareholders including full run rate synergies from FY26. MyState expects that operational integration will largely be achieved by the end of FY27 at which point the business will have realised the ongoing benefits of the merger.

The main sources of synergies are expected to include the consolidation of technology platforms, the integration of shared services, a refined leadership and management structure and consolidation of third party providers.

FY25 earnings will be impacted by upfront transaction and integration costs.

Profile of the merged group

The merged group is expected to have a pro forma loan book of $12.5 billion, net assets of $755 million and total deposits of $9.6 billion. The merged group will have a pro forma CET 1 capital ratio of 12.1% as at 30 June 2024 (relative to MyState’s standalone CET 1 capital ratio of 12.0% as at 30 June 2024).

Implementation process

The Proposed Merger is subject to Auswide shareholder and Court approval and requires Auswide shareholders to approve the scheme by the requisite majorities in accordance with the Corporations Act. The Proposed Merger is also conditional on regulatory approval from the Treasurer under the Financial Sector Shareholdings Act as set out in the SIA.

Confidence in successful integration

The Proposed Merger is being undertaken on a collaborative basis. Following the implementation of the Proposed Merger, the merged group Board and management will make key business decisions, ensuring minimisation of disruption to both businesses and their customers.

The Proposed Merger is not expected to have an impact on MyState’s TPT Wealth business.

Key dates

| Lodge regulatory applications | August 2024 |

| Lodge Scheme Booklet with ASIC | September 2024 |

| First Court date application served on ASIC | October 2024 |

| First Court date | October 2024 |

| Dispatch Scheme Booklet | October 2024 |

| Scheme meeting held (Auswide shareholder vote) | November / December 2024 |

| Second Court date | December 2024 |

| Record date | December 2024 |

| Implementation date | December 2024 |

Advisors

Gresham Partners is acting as financial advisor to MyState and HWL Ebsworth Lawyers is acting as legal advisor.

Conference call details

Investors and analysts are invited to join a teleconference call hosted by Brett Morgan, Managing Director and Chief Executive Officer and Gary Dickson, Chief Financial Officer on Monday 19 August at 11:00am AEST.

Participants must register for the teleconference call at this link:

https://s1.c-conf.com/diamondpass/10038425-8ogic4.html

1 Relative to prior corresponding period (pcp)

2 Assumes that Auswide raises $15m in equity through its placement and SPP as announced on 19-Aug-24, lower investor participation may impact final exchange ratio and ownership outcomes. Auswide has concurrently entered a binding agreement to acquire 100% of Specialist Equipment Leasing Finance Company Pty Limited (Selfco), an established non-bank small to medium enterprise asset finance lender. If the Selfco transaction does not close on or before 30 September 2024, Auswide shareholders are expected to receive a consideration that results in 33.6% pro forma ownership in the combined Group which is equivalent to an exchange ratio of 1.112x new MyState shares per Auswide share.

APPENDIX