Easy to use, with a big focus on friendly

You want your money locked tight and ready when you are. So that’s what we have for you here.

Easy

Our online banking is fast-loading and easy to move around. You shouldn’t need to spend too much time thinking about it.

Friendly

No jargon or complex banking terms…just plain simple language.

Secure

The technology we use to protect you includes face and fingerprint ID on supported devices and multi-factor authentication.

Want to see how things work?

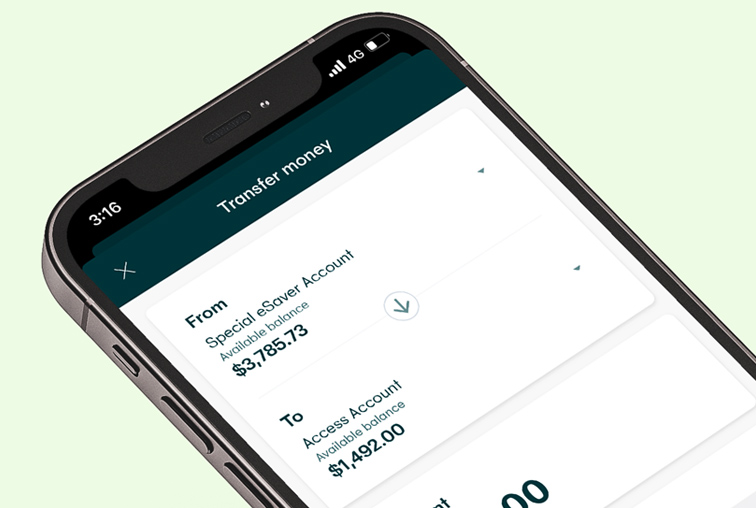

App banking

To make payments on the fly, check your balances, move money, and get the everyday tasks done.

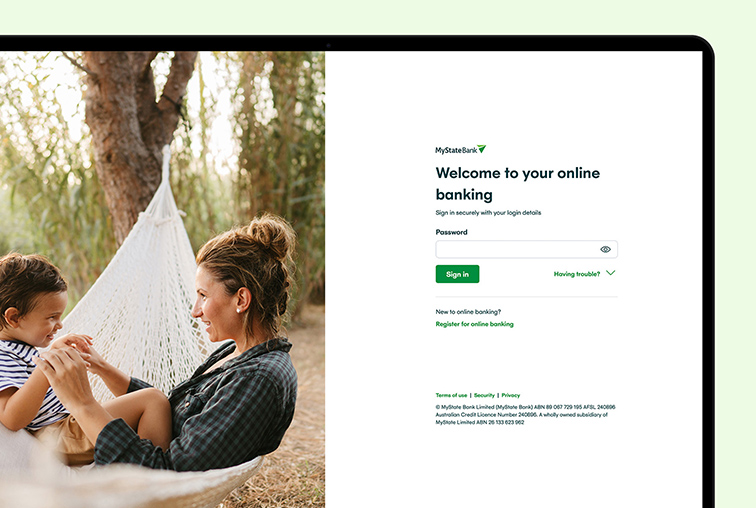

Internet banking

For all your big-screen banking needs, like tax prep, reviewing statements, and filtering transactions.

You’ve got payments sorted

Digital wallets

You can pay with your phone or wrist with Apple Pay™, Google Pay™, Samsung Pay™ and Garmin Pay™. Check out our digital wallets pages for more information. Learn more

PayID

You can make payments easier by using your mobile number or email with PayID and faster with Osko near real time transfers. Learn more

PayTo

You can also view and manage payment agreements quickly and easily right in the security of your online banking, keeping you in control of your payments. Learn more

And can take care of the basics

Limits

Update your payment limits quickly and easily.

Cards

Manage temporarily lost cards, cancel stolen cards, replace cards, and change that PIN.

Notifications

Keep up to date with message notifications.

Messages

Easily send us secure messages with attachments from your app or internet banking.

And get help if you need it

Not sure how to find your way around the app or your internet banking? Find your help videos here.

Introduction

The MyState Bank mobile app.

Log in

The easy way to log into the app, including Face ID.

Accounts

The easy way to manage your accounts on the app.

Profile and security

The easy way to manage your profile and security on the app.

Deposits

The easy way to make a deposit on the app.

Recurring transfers

The easy way to schedule recurring transfers on the app.

Payments

The easy way to make a payment on the app.

Contact us via the app

The easy way to contact us through the app.

Introduction

MyState Bank internet banking.

Log in

The easy way to log into internet banking with 2-step verification.

Accounts

The easy way to manage accounts on internet banking.

Profile and security

The easy way to manage your profile and security on internet banking.

Cards

The easy way to manage your cards on internet banking.

Deposits

The easy way to make a deposit on Internet Banking.

Recurring transfers

The easy way to schedule recurring transfers on internet banking.

Want to know more?

Help yourself with more information in our help centre.

You can register for online banking through internet banking on your desktop or via the mobile app.

Internet banking

- Go to mystate.com.au

- Log into internet banking.

- Select Register for online banking.

- Follow the steps using either your personal details or information on your Visa Debit card.

Mobile app

- Select Register for online banking.

- Follow the steps using either your personal details or information on your Visa Debit card.

Here’s how:

- Open Google Play or the Apple App Store on your device and type ‘MyState Bank’ in the search bar.

- Download the MyState Bank App.

- Open the app.

- If you’re registered you can log in using your customer number and password.

- If you’re not already set-up, you can select Register for online banking.

You can try resetting your password/passcode after a period of time by selecting Forgot password/passcode. If you can’t wait, you can call us on 138 001 and we can help you get back into your banking.

Head to the app or internet banking and hit the Forgot password link.

The link expires in 12 hours. If you need a new one, please call us on 138 001.

You can update your payment limits on the app or internet banking. These limits are broken down into different types:

- Osko payment - these are your NPP or near real-time payments that are usually completed in a couple of minutes.

- Standard transfer - this type of transfer may take up to 3 business days to be completed.

- BPAY® - your bill payments through online banking.

Your payment limit includes all payments you make from the app or internet banking in a day, plus any scheduled payments that have been set up to go out on that same day.

If you need a higher limit to what’s available please call us on 138 001.

Yes, you can redraw from your home loan or personal loan account via the app or internet banking if you have an eligible product that allows you to redraw.

You must have a MyState Bank account to have the redraw balance transferred into.

Resources

Financial services guide

Terms & conditions

Fees and charges

Interest rates

Switch your salary over

Overseas travel

Inward telegraphic transfer

SMSF options

Bank account calculators

App Store and the Apple logo are trademarks of Apple Inc. Google Play and the Google Play logo are trademarks of Google LLC.

® Registered to BPAY Pty Ltd ABN 69 079 137 518.